Lessons Learned: 3 key factors of a successful budget

– By Yusun Ingoshi With finances, planning is key. Creating a budget and putting time and energy into planning out money management isn’t only important

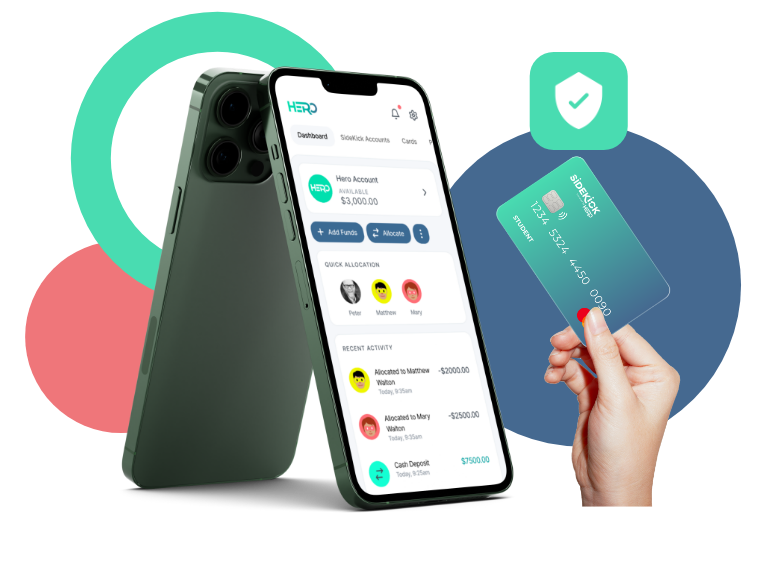

A hero has great strengths – financial freedom, technology juggler, adventurous. We developed solutions that complement your kids’ lifestyle and deliver the things that matter the most to them. A creative alternative to traditional banking that evolves as your kid’s superpowers grow and change!

Hero Financials sets you up with a separate account for you and your child, so you can have peace of mind that they have a secure and reliable way to pay for their daily activities.

Get full transparency on how they’re paying for their daily routine, so you can work together to build good financial habits, even if your kid is not by your side.

As parents, you are the first hero for your kids. Now, it’s the time to help your kids create their Hero account to unleash the power of their finances!

SideKick Card Canada is here to empower your kids to pay for expenses on their own. They no longer have to rely on being with you to pay for their daily activities. No more carrying cash and change around to buy ice cream. No more using your credit card to pay for parking. It even comes with a full range of financial literacy features to help them learn along their journey.

Are you looking to make international transfers to Canada? SideKick Card International ensures your kids get the maximum of the funds you send them. We offer competitive exchange rates, safe transfers, and low fees. Get full transparency on how they’re paying for their daily routine, so you can work together to build good financial habits, even from far away.

Use the Hero Budget Tool to divide money between our pre-created categories: general, living expenses, eating out, travel, shopping, and fun. Each category was well thought out to help you budget for what is important for your kids.

You can control how much is on the card and allocate the funds to each category. As parents, you have the superpower of moving money between categories or adding money to only a specific one. You are in control!

Accelerate your savings and growth of your investments with “Round-Up” settings. Whatever change you spare during transactions, HERO deposits it into your Savings account. Reach your goals faster with HERO.

Easily set up daily, weekly or monthly allocations. Recurring allowances help kids plan to spend it wisely, set savings goals & more. Skip the trip to the ATM — and choose when your kids are paid. Pick a day and decide how often you’d like their payout to hit.

See where the money’s going with real-time spending updates on the Hero Portal and the app. Need to top-up your kid’s card? Simply log in to your Hero Portal, load your account and transfer money to the SideKick Card. It’s super fast just like a hero.

It’s important that the money is safe and is accessible by your kid only. In case the card was misplaced or lost, you or your kid can lock it remotely through the Hero Portal or the app. Found the card? No problem, unlock it right away and it’s ready to spend.

What better way to learn than by doing? Kids usually learn more by practicing than only with theory. Hero empowers your kid’s independence by giving them the secret tools they need to become financially-smart adults.

or $18.99/Year

or $49.99/Year

or $69.99/Year

– By Yusun Ingoshi With finances, planning is key. Creating a budget and putting time and energy into planning out money management isn’t only important

It’s important to understand the Canadian banking system to make sure you’re managing your money in the best way. Banking in Canada is fairly straightforward,